Eleven Oaks Realty is proud to present their April 2013 Austin Foreclosure Market Report measuring activity in the single family home foreclosure market.

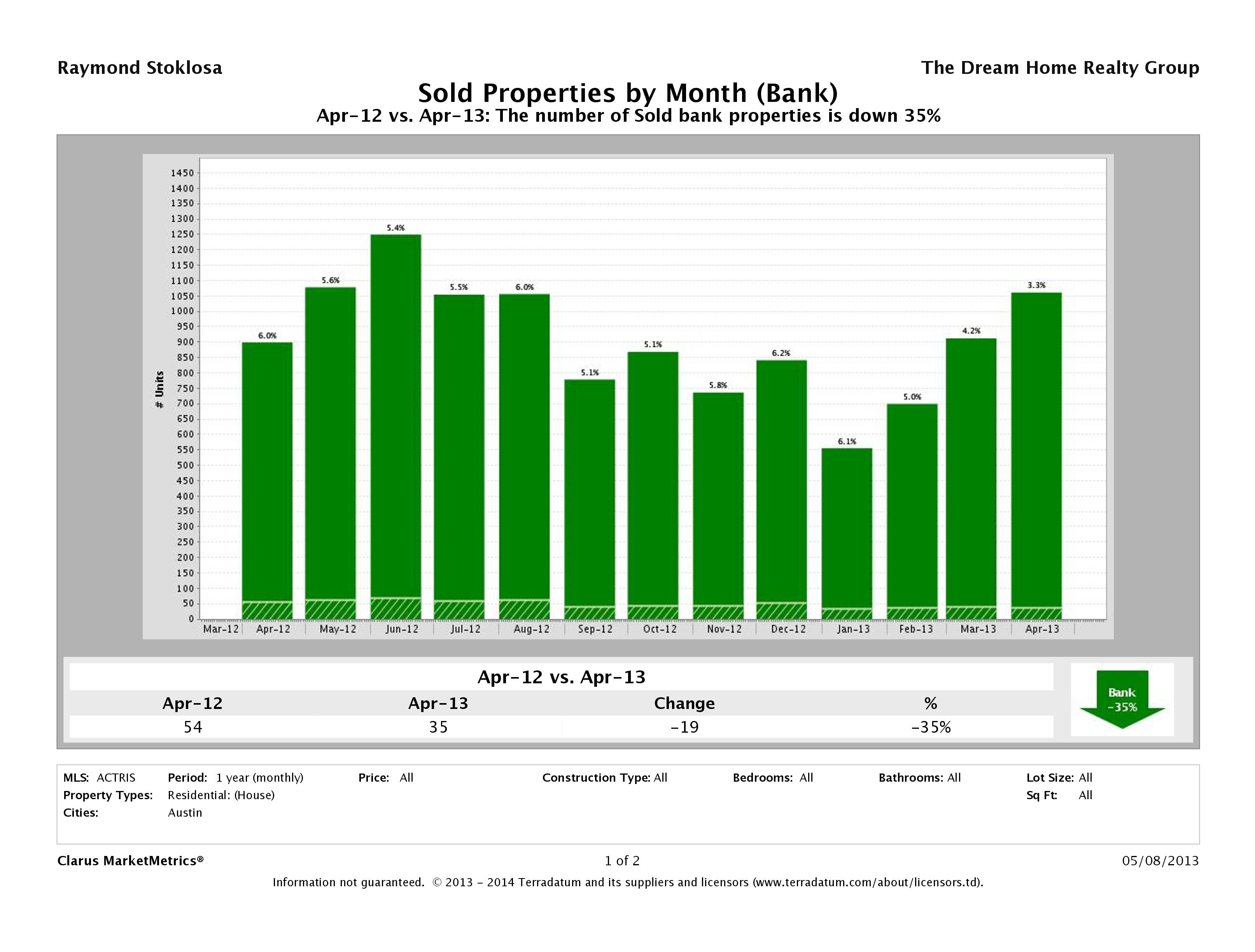

Austin Bank Owned Properties Sold Down 35%

April 2013 saw a 35% decrease in the number of bank owned homes sold in year over year figures. In April 2012, there were 54 homes that sold (closed escrow) compared to just 35 homes in April 2013. Bank owned homes (foreclosures) accounted for just 3.3% of the total home sales in Austin, compared to 6% of the total sales in April 2012. The overall market saw a 19% increase in the number of homes sold compared to last year’s numbers.

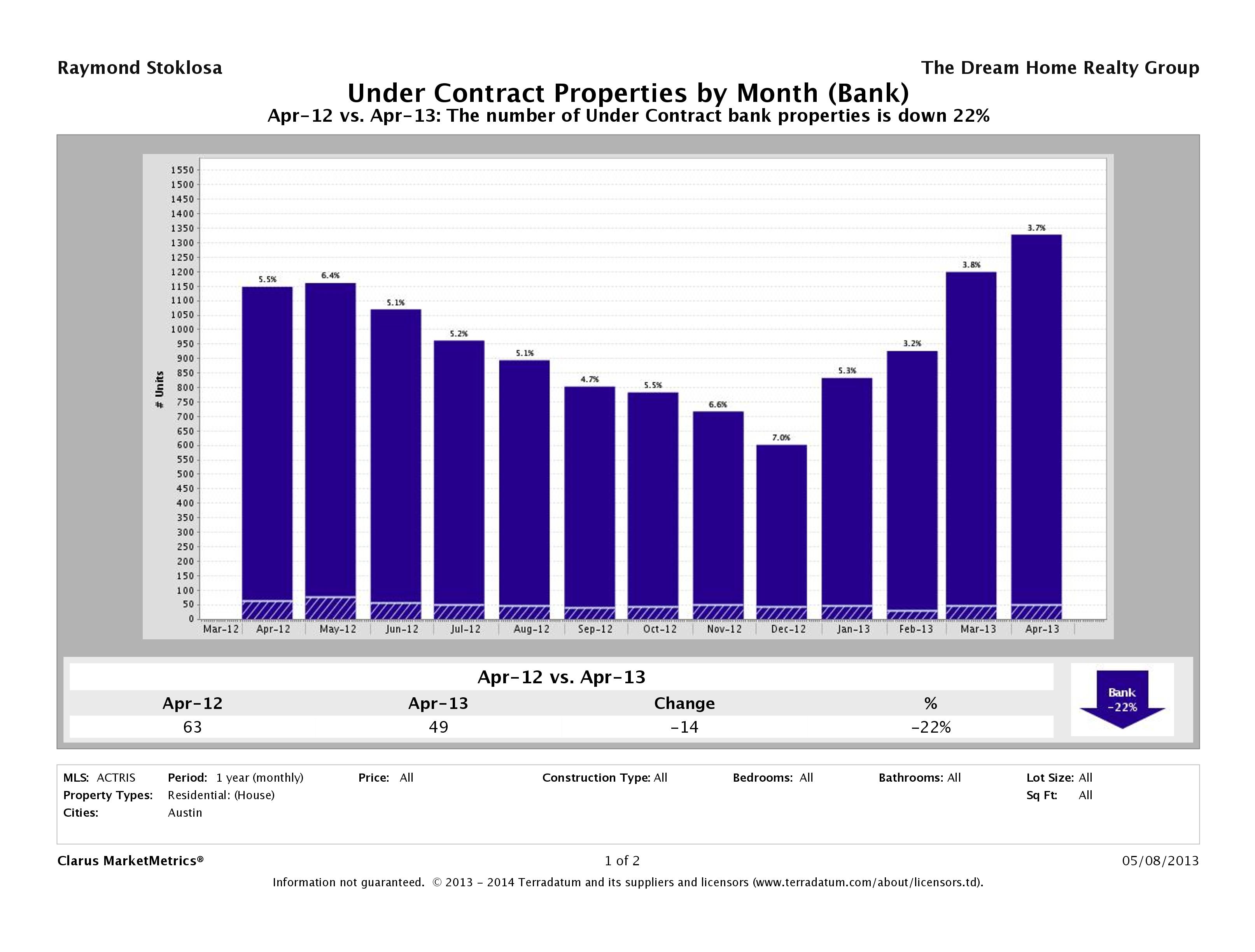

Austin Bank Owned Homes Under Contract Down 22%

Also trending downward was the number of bank owned homes, foreclosures, that accepted a contract. In April 2013, there were 49 homes that accepted a contract (pending) compared to 63 homes in April 2012 marking a 22% (14 home) decrease in year over year numbers. Bank owned homes accounted for only 3.7% of the homes that went under contract. The total market had a 15% increase in the number of homes that went pending compared to last year at this time, showing just how small a percentage the distressed market takes in Austin.

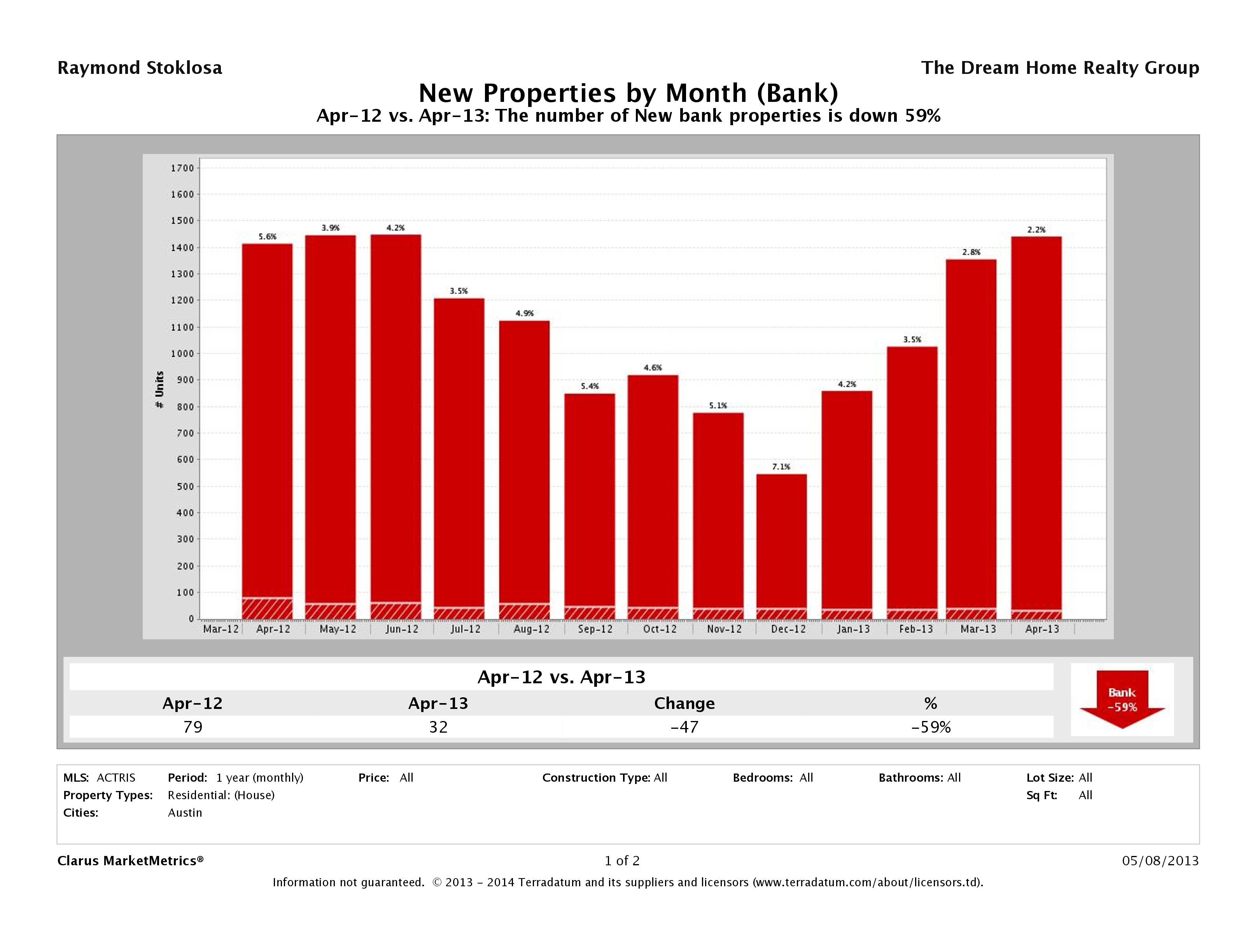

Austin Bank Owned Listed for Sale Down 59%

In April 2013, we saw a 59% (47 home) decrease in the number of bank owned homes, foreclosures, listed for sale. In April 2012, there were 79 foreclosures (homes owned by the bank) listed for sale compared to just 32 in April 2013. We hear all the time about “shadow inventory” and banks holding any homes they own to later flood the market, but it doesn’t seem like that is going to be the case, at least for the foreseeable future. With the Austin housing market as hot as it is, if banks had more inventory to sell, I think they would take advantage of the increased demand and start to release more of their homes and put more money in their pockets.

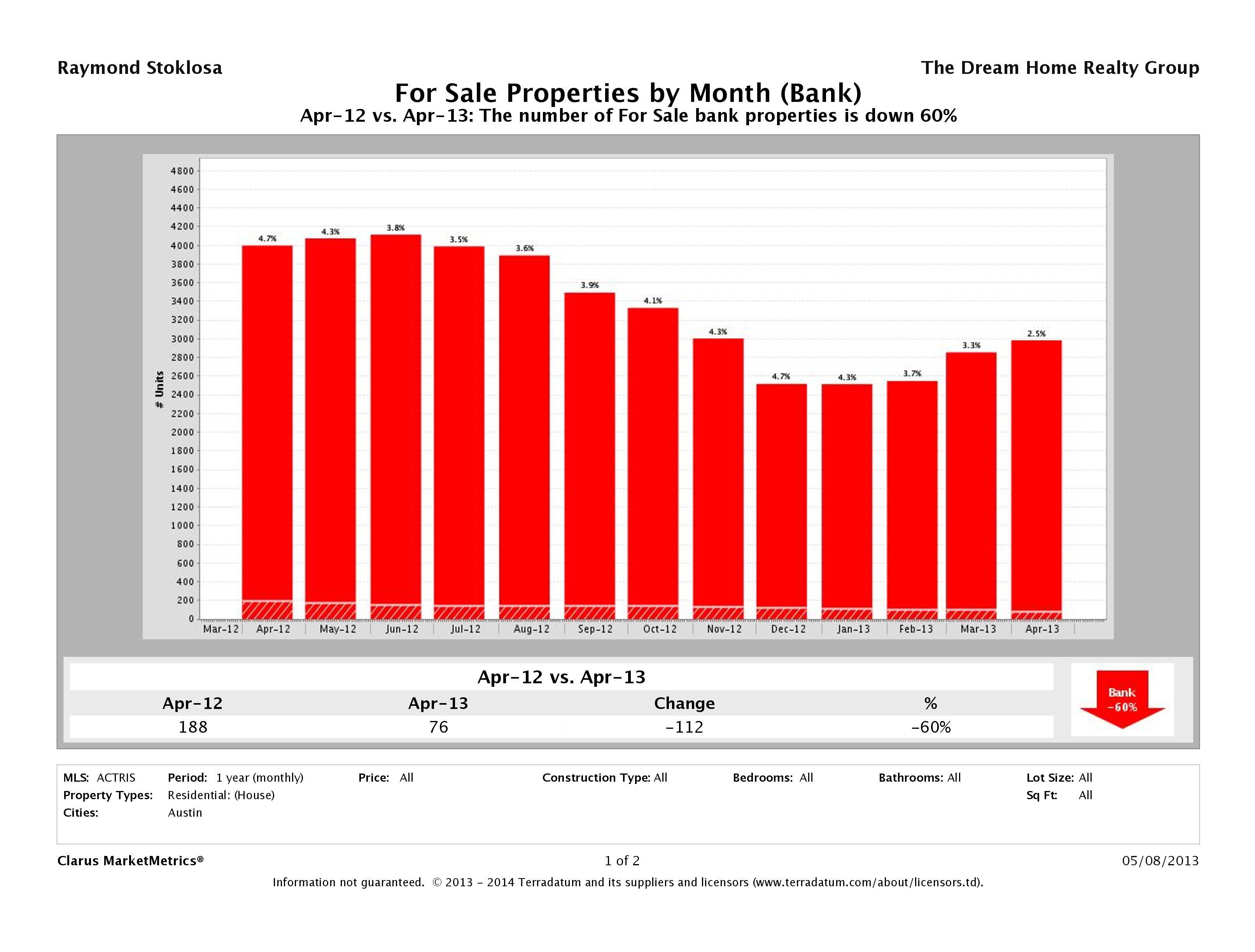

Austin Bank Owned Homes Currently for Sale Down 60%

The number of bank owned homes in Austin currently on the market went from 188 in April 2012, to just 76 in April 2013 marking a 60% (112 home) decrease. The full market was down 25%, which is nothing compared to the bank owned market. Number of bank owned homes for sale made up just 2.5% of the market in April 2013. It seems buyers are recognizing deals with buying bank owned homes and moving them off the market.

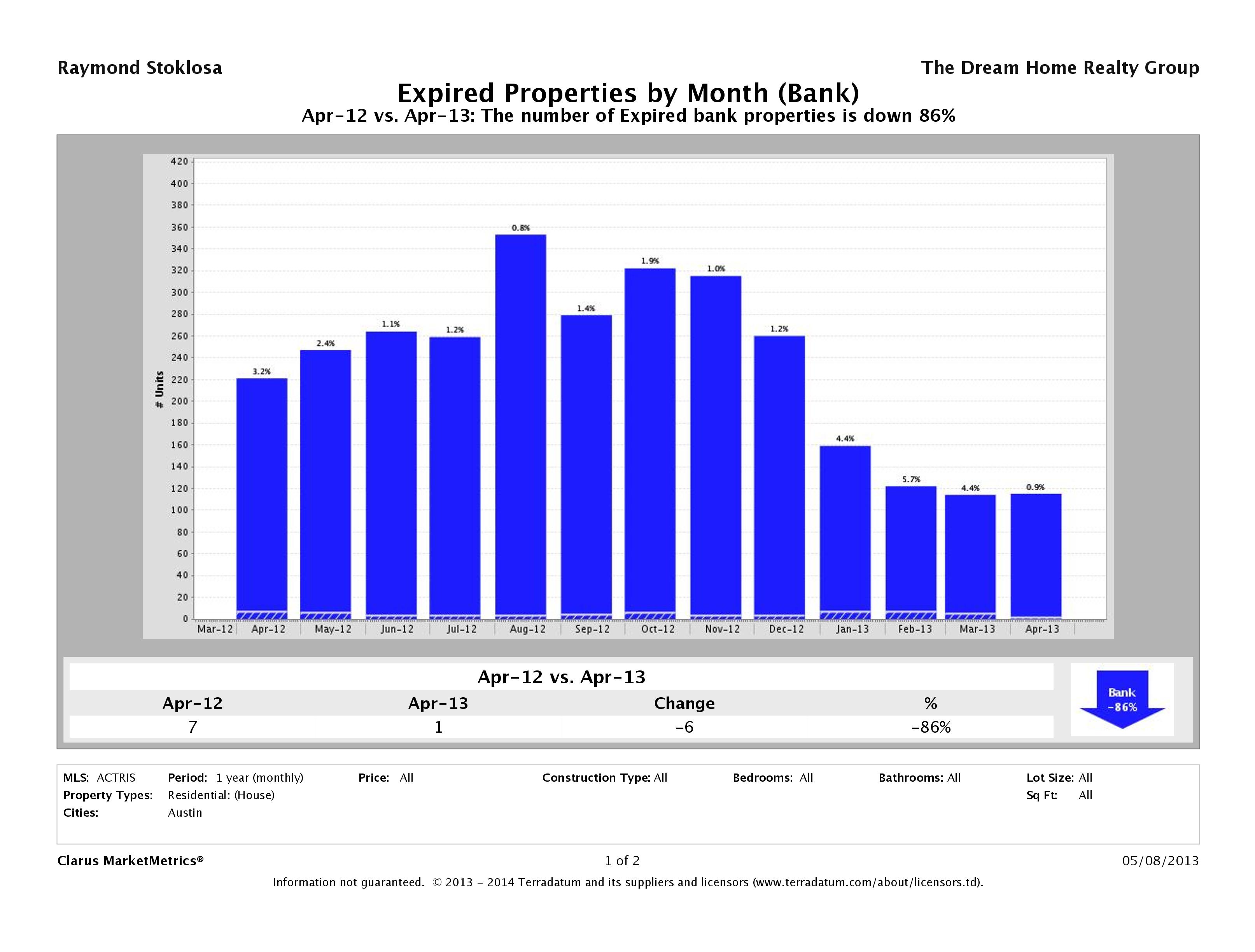

Austin Bank Owned Homes that Didn’t Sell Down 86%

In April 2012, banks took 7 homes off the market that didn’t sell compared to just 1 that was taken off the market in April 2013. As with the overall market, buyers are snatching up bank owned home inventory where even the ones in poor condition are selling (for the right price). Bank owned homes taken off the market in April 2013 were just 0.9% of the total homes that were taken off the market, showing there really is a demand for bank owned homes and that banks price their homes to sell and sell quickly.

What Do Austin Foreclosure Numbers Mean for Buyers?

Bottom line if you are pursuing foreclosures in Austin as part of your home buying strategy, make it just that – part of your strategy. With so few bank owned homes on the market in Austin, you should open up your search to both homes owned by the bank and homes owned by traditional sellers. Remember, the traditional seller has to compete with bank owned properties if they want to get their homes sold. And, with interest rates as low as they are, you might find yourself paying even more for a bank owned home if you wait until the end of the Summer.

Looking to Buy a Foreclosure in Austin?

With a combined 55+ years of experience, our team knows how to get banks to accept your offers, even in a competitive market like we’re seeing here in Austin. For more, check out Guide to Buying Foreclosures in Austin and our Buying a Home in Austin Guide. Then, call us at (512) 827-8323 or email us at info@11OaksRealty.com to schedule a no obligation conversation. Together we can come up with the best strategy for you to buy a bank owned home in 2013.

Leave a Reply